south dakota vehicle sales tax rate

The average local tax rate in North Dakota is 0959 which brings the total. The South Dakota use tax should be paid for items bought tax-free over the internet bought.

South Dakota Vehicle Registration Vehicle Registration Services Dakotapost

If you have titled and licensed your vehicles in another state you will be granted reciprocity.

. 2022 List of South Dakota Local Sales Tax Rates. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. The parts store owes 45 state sales tax on 220.

Its important to note. Lowest sales tax 45 Highest sales tax. South Dakota has a 45 statewide sales tax rate but also has 290 local tax jurisdictions.

The South Dakota sales tax and use tax rates are. As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South. The base state sales tax rate in South Dakota is 45.

Average Local State Sales Tax. Rate search goes back to. Free Unlimited Searches Try Now.

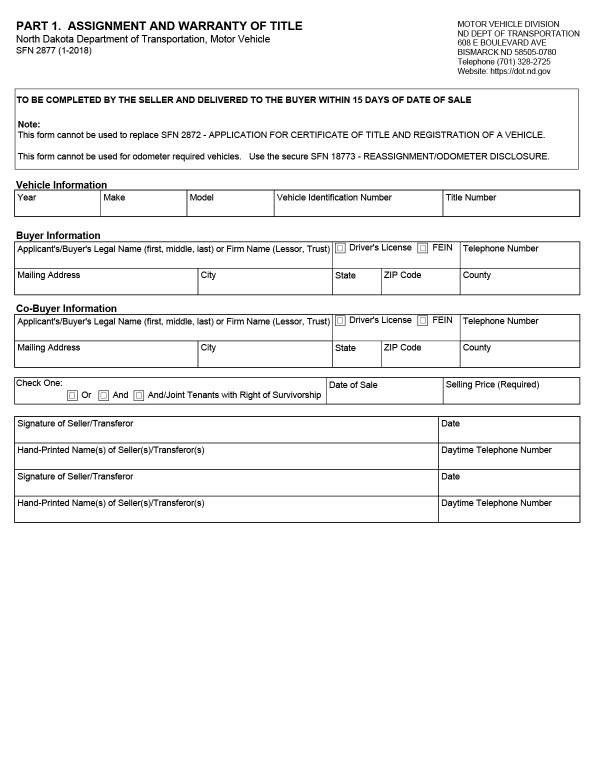

All car sales in South Dakota are subject to the 4 statewide sales tax. One field heading that incorporates the term Date. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

Motor vehicles registered in the State of South Dakota are subject to the 4 motor vehicle. Depending on what the dyed fuel is being used for will determine the tax rate that is paid. The South Dakota state sales tax rate is 4 and the average SD sales tax after local.

What is South Dakotas Sales Tax Rate. Ad Get South Dakota Tax Rate By Zip. For traditional business owners selling goods or services on site calculating sales tax is easy.

Tax Rate State sales tax 45 2115 Rapid City sales tax 2 940 Tourism Tax 15 705. Car sales tax in South Dakota is 4 of the price of the car. No municipal sales tax is due because the.

Local tax rates in South Dakota. The 45 sales tax rate in Marvin consists of 45 South Dakota state sales tax.

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Titles Licensing Lawrence County Sd

About Bills Of Sale In North Dakota What You Need To Know

States With The Highest Lowest Tax Rates

All Vehicles Title Fees Registration South Dakota Department Of Revenue

Minnesota Sales Tax Calculator And Local Rates 2021 Wise

Vehicle Registration Cost Calculator South Dakota

Motor Vehicle South Dakota Department Of Revenue

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Car Tax By State Usa Manual Car Sales Tax Calculator

Form E1334 V2 Fillable Affidavit Of Vehicle Repossession

States With No Sales Tax On Cars

Form Dor Mv215 Fillable Affidavit Of Vehicle Repossession

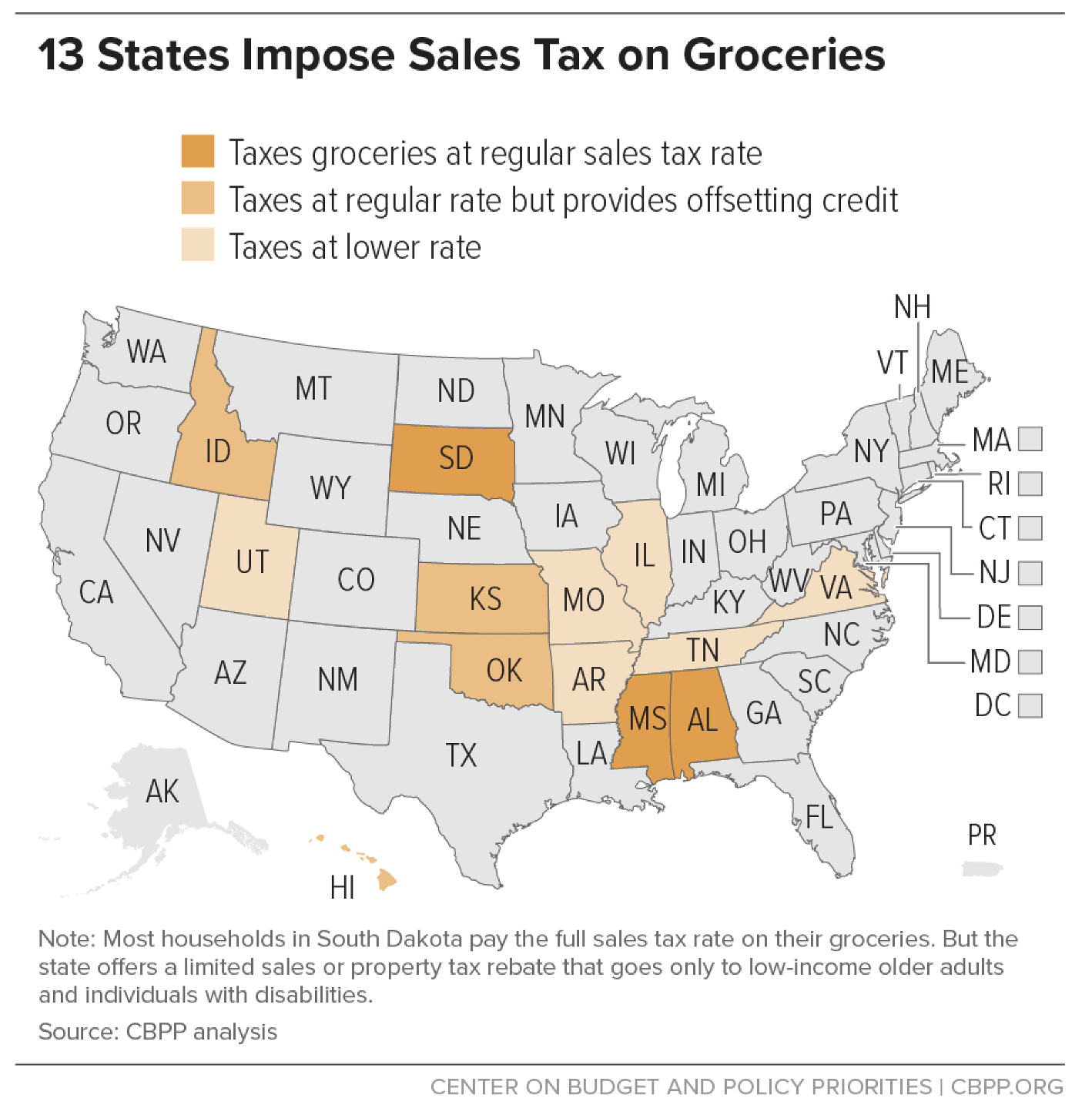

Democrats Persuade Noem To Promise Food Tax Repeal Smith Winning Dakota Free Press

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal